Phases of Loan Origination

Loan Origination is one of the most important stages in loan servicing. Every lending company has a process that works for them. They decide how it starts, the different stages and where it ends.

This is considered a competitive advantage for companies as it provides lenders with insight on how to improve the process so as to tap into uncaptured market segments.

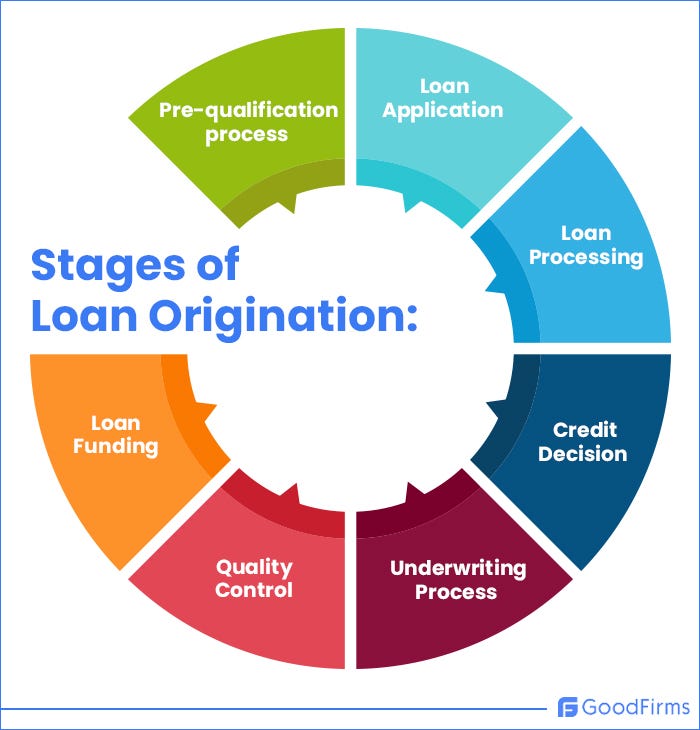

The following are the stages of the Loan Origination process:

Stage 1: Pre-Qualification Process

This is the very first stage of the loan origination process. At this stage, the potential borrower is given a list of all the items that are required to submit to the lender to get a loan. This may include documents like ID cards, NIN, BVN, Voter ID, and bank statements.

After the information is submitted by the borrower, loan underwriters review the documents. If everything is acceptable, a pre-approval is declared that allows the borrower to continue in the loan application process.

Stage 2: Loan Application

At this stage, the borrower completes the loan application. This process can either be paper-based or electronically monitored depending on the choice of the lender.

Lenders are beginning to adopt new technologies that make completing the application online easy through the website & mobile app.

Stage 3: Application Processing

After receiving a loan application, at this stage, the application is processed.

Lending companies count on loan management systems to accurately assess the creditworthiness of borrowers and even facilitate the easy processing and decision of loans.

Stage 4: Underwriting Process

The underwriting process helps determine if a potential borrower should get the funds or not. At this point, risk analysts evaluate the application against various criteria like credit score and repayment ability, among other things.

Different financial lending companies have their own criteria for scoring that are guided by industry standards.

Our platform and API integration makes the process error-free and quick.

Stage 5: Credit Decisioning

This phase is where an application is approved or denied, depending on the result of the underwriting process.

Using an automated process for credit decision allows a degree of predictability in the process. Even if there are changes in the loan decision parameters such as interest rates or tenure, they can be implemented into the system without any significant delays.

Stage 6: Quality Check

Quality check is a vital aspect of the lending process. A typical loan application is sent to the quality control queue for auditing to ensure compliance with guidelines issued by the relevant authorities. This helps financial institutions avoid penalties and consumer lawsuits in case of a dispute.

Stage 7: Loan Funding

Funds are disbursed once the borrower meets the whole criteria.

Conclusion

Companies that use loan management software can easily track funding and ensure that all the needed documents get executed before or together with funding. Lending companies that value their customers should welcome technology upgrades such as new-age loan origination software to ease the lending process on the whole.

There is a need for businesses to leverage loan origination solutions that creates loyal customers. There are a lot of lending platforms out there, hence borrowers are spoilt for choice and can only be swayed with reasonable interest rates and prompt loan servicing. Technological advancements also benefit lenders by helping them make credit decisions more efficiently.

Our channel optimizes each stage of a borrower’s journey through the lending process.

Ready to get started?

Creditclan helps financial institutions and businesses provide credit to consumers across Africa.

If you are looking to scale your business with technology for credit, credibility and collection. Drop us a line at care@creditclan.com or support@creditclan.com